Investing in Wealth: The Ultimate Guide to Buy Physical Gold

If you're searching for a reliable way to secure your financial future, buying physical gold might just be your best bet. Gold has been a treasured asset for centuries, serving as a hedge against inflation, economic instability, and currency devaluation. At Don's Bullion, we specialize in providing our customers with high-quality gold bullion, alongside silver, platinum, and palladium products.

The Timeless Appeal of Gold

Gold has held a significant place in human history as a symbol of wealth, power, and prestige. The reasons for its continued allure are manifold:

- Intrinsic Value: Unlike fiat currencies, gold has intrinsic value due to its limited supply and high demand worldwide.

- Inflation Hedge: Gold often appreciates during times of inflation, making it a safe haven for investors seeking to preserve their purchasing power.

- Global Acceptance: Gold is recognized and valued across the globe, which facilitates easier trade and liquidity.

Why Buy Physical Gold?

Investing in physical gold offers numerous advantages that can provide financial stability:

- Tangible Asset: Physical gold is a tangible property that you can hold in your hands, providing peace of mind that digital assets cannot offer.

- Portfolio Diversification: Including gold in your investment portfolio can help balance risks, especially in times of market volatility.

- Security: Gold maintains its value over time, which can safeguard your wealth against economic turmoil and governmental instability.

How to Buy Physical Gold: A Step-by-Step Guide

Buying physical gold may seem daunting, but following these steps can simplify the process for you:

Step 1: Determine Your Investment Goals

Understand why you want to buy physical gold. Are you looking for a long-term investment, a hedge against inflation, or a way to diversify your portfolio?

Step 2: Research Different Types of Gold Products

Gold can be purchased in various forms, including:

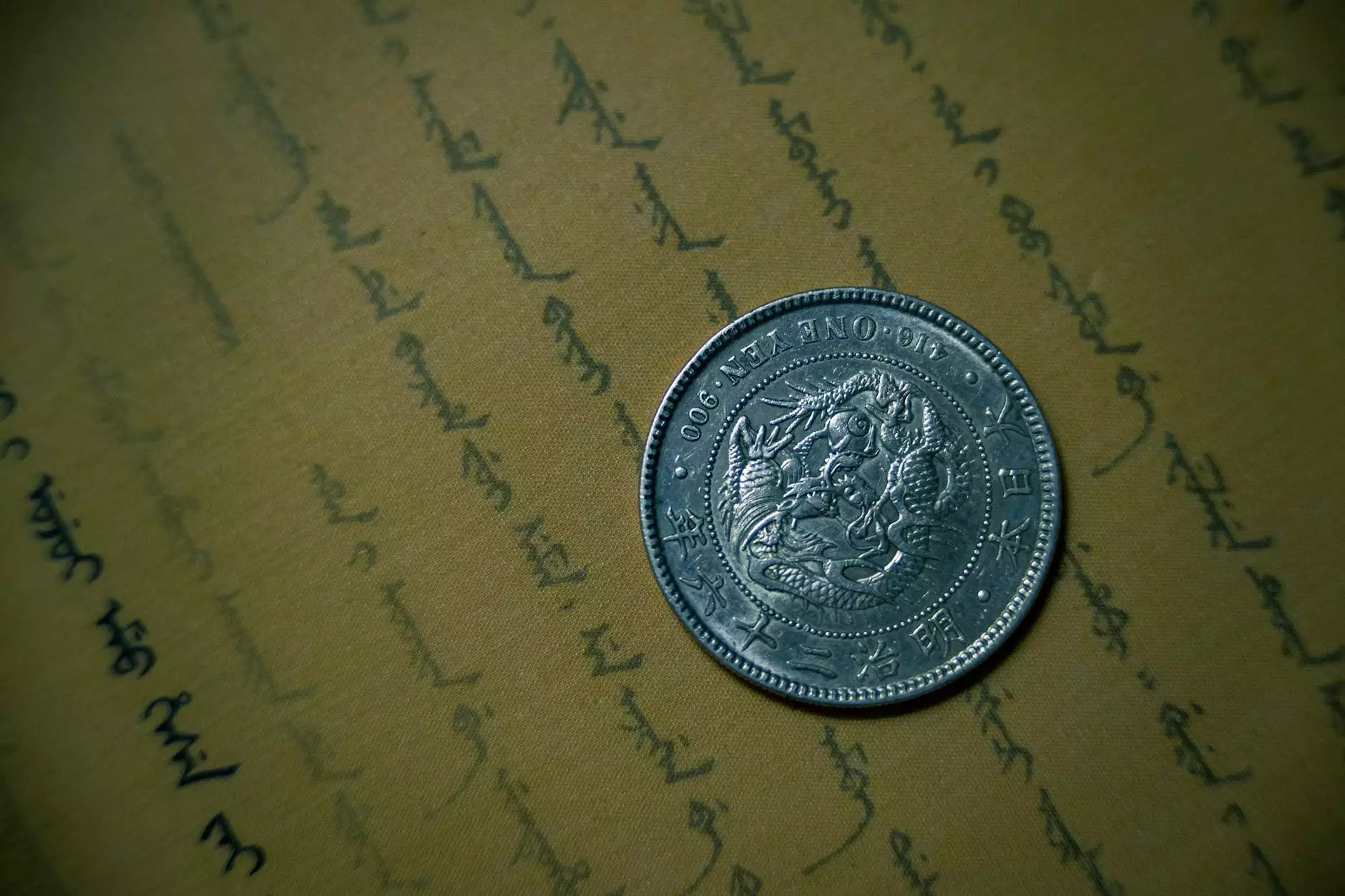

- Gold Bullion: These are large gold bars or coins that contain a specified amount of gold.

- Gold Coins: Coins such as American Eagles, Canadian Maple Leafs, and South African Krugerrands are popular choices.

- Gold Jewelry: While not as pure as bullion or coins, certain pieces can also serve as a form of gold investment.

Step 3: Select a Reputable Dealer

Choosing a trustworthy dealer is crucial for a safe transaction. Don's Bullion is known for its integrity, offering a wide selection of gold and other bullion products. Always look for:

- Transparent pricing

- Positive customer reviews

- Certifications and industry affiliations

Step 4: Understand the Pricing

Gold prices fluctuate based on various factors, including market demand and global economic conditions. Make sure to review:

- Spot Price: The current price at which gold is trading on the market.

- Premiums: Additional costs added to the spot price by dealers, accounting for minting and distribution expenses.

Step 5: Make Your Purchase

Once you have settled on a dealer and understood the pricing, it's time to proceed with your purchase. Ensure you:

- Confirm the authenticity of the product.

- Inspect the condition of the gold upon receipt.

- Securely store your physical gold in a safe or safety deposit box.

Storing Physical Gold Safely

After you have bought physical gold, ensuring its safety is paramount. Here are some effective storage options:

- Home Safes: Investing in a quality safe can provide peace of mind, but keep in mind that home burglaries do occur.

- Bank Safety Deposit Boxes: These offer a high level of security and are less accessible than keeping gold at home.

- Private Vaults: These facilities offer both security and privacy for your investment, often with insurance options available.

The Role of Gold in a Diverse Investment Portfolio

In the realm of investments, diversification is key. Including gold in your portfolio can provide insulation against volatile stock markets and downturns in the economy:

- Low Correlation with Stocks and Bonds: Gold often moves independently of other asset classes, making it an effective hedge.

- Store of Value: Gold has been regarded as a stable store of value, often retaining its worth over the long term.

- Inflation Resilience: Gold's tendency to retain value in inflationary periods reinforces its status as a safe-haven asset.

Frequently Asked Questions About Buying Physical Gold

When considering to buy physical gold, several questions typically arise:

1. Is it better to buy gold coins or gold bars?

This depends on your investment goals. Gold bars typically have a lower premium than coins, making them more cost-effective for larger investments. However, coins may be more liquid and recognizable, which can ease resale.

2. How can I tell if my gold is genuine?

Authenticity can be verified through assays or tests conducted by professionals. Look for recognizable brand stamps and certifications, which help ensure the quality of your investment.

3. What is the best time to buy gold?

Timing the market can be tricky, but buying during periods of lower prices can maximize your investment. Monitoring economic indicators may also provide insights into optimal buying times.

Conclusion: Secure Your Future Today

Investing in physical gold is a strategic decision that can secure your financial future. With its history of stability, growth, and reliability, gold offers a tangible way to protect your assets against economic fluctuations. Whether you aim to buy physical gold for diversification, wealth preservation, or simply as a hedge against inflation, Don's Bullion is here to guide you every step of the way. Explore our selection of precious metals today and make a wise investment that will serve you for years to come.